Why the Misunderstanding of “Tax the Rich” Is a Problem

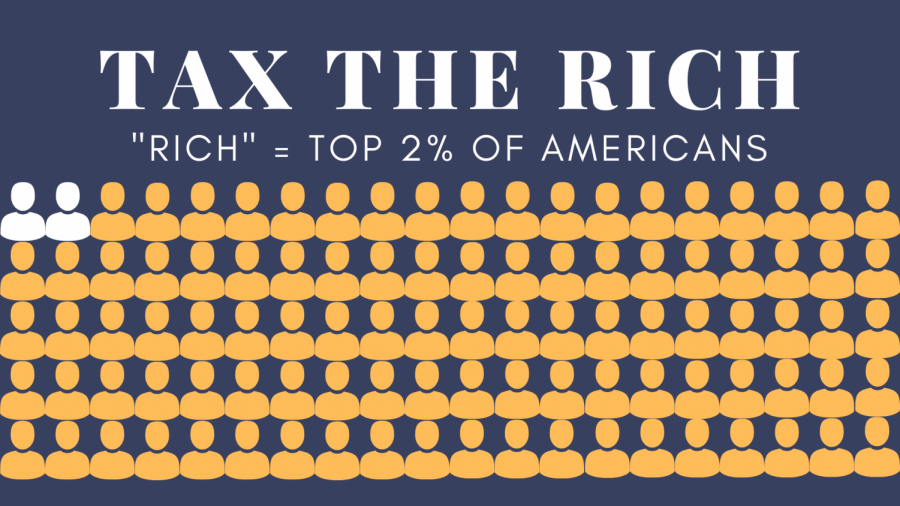

“Taxing the Rich” means taxing the top 2% of Americans according to the wealth tax that President Biden is proposing.

September 29, 2021

When progressive Democrats use the term “tax the rich,” it is to target the top 2% of America’s wealthiest, nothing else.

A common misconception around taxing the rich is that taxes would increase for almost anybody making a well-off or comfortable income. This is false.

The term was created in 1935 when the original wealth tax was being proposed, and when it passed, the wealthiest people in America were paying as high as 91% of their income.

Nearly a century later, “tax the rich” is still being used because the billionaires of America are earning money at an exponential rate and paying very little or even nothing in federal taxes.

So who exactly is “the rich?” President Biden’s proposal is that the federal income tax goes up to 39.6% from the 37% that it is currently at for individuals who make $453,000 or more and couples who make $509,000 more.

For reference, this is the top 2% of “Americans,” meaning any family or individual making less than $453,000 per year, which is 98% of the population, will not face any tax increase under Biden’s proposal.

A ProPublica report about billionaires like Jeff Bezos, Elon Musk, Warren Buffett, Mike Bloomberg, and 21 others uncovered hidden IRS files documenting that all of these men combined earned $401 billion from 2014-2018 but only paid $13.8 billion in federal taxes.

While this seems like an incredible amount of money, it adds up to only a 3.4% income tax combined.

For reference, the average American pays a 14% income tax.

In other words, your families are paying a higher tax rate than a billionaire.

While many high-profile billionaires are making more money than ever, such as Elon Musk, Jeff Bezos, and even Mike Bloomberg, have managed to pay $0 in federal income taxes at least once in the last decade.

In the American tax system, it is perfectly legal for people earning this much money to pay only a small fraction of the hundreds of millions or billions of dollars they are making every year. This is because their wealth often comes from stock, property, or other assets that are not taxable in the US system until they are sold due to the capital gains tax, which is a levy on the profit from an investment that is incurred when the investment is sold.

In Switzerland, their wealth tax includes paying taxes on shares because they are not tax-deductible. This means that any investments or money you have in shares can be taxed in the Swiss system making for a much higher tax rate on the wealthy.

If America started allowing this, billionaires would be unable to evade taxes on things they are making so much money off of.

A common misconception is that a federal income tax means you pay a certain percent of your total income. This is not true because, instead, we have marginal taxes.

A marginal tax is when you pay a percent of different portions of what you earn. Your income is broken down into tax brackets that separate your income into sections, and you get taxed on each one. The brackets have a wide range of income, making for a smaller tax rate than if it were to be a tax on your total salary.

These are the tax brackets as of 2021, but they change almost every year.

The current United States tax system allows the ultra-rich to evade their taxes and not pay them like every other American. The system needs to be changed in order to prevent this from continuing to happen.

Why are we letting 1% of Americans take home 20% of the country’s wealth? It is unfair, unconstitutional, and unethical. Taxing the rich would only force them to pay their fair share of taxes and the same debt to society as everyone else.

Lisa Daniels • Sep 30, 2021 at 10:33 am

Kudos for taking on such a complex topic!

Sid Lefranc • Sep 29, 2021 at 9:30 pm

This was perfectly relevant and informative, thank you for the awesome article!